Conor Sen points out that a house price fall could lead to some economic problems.

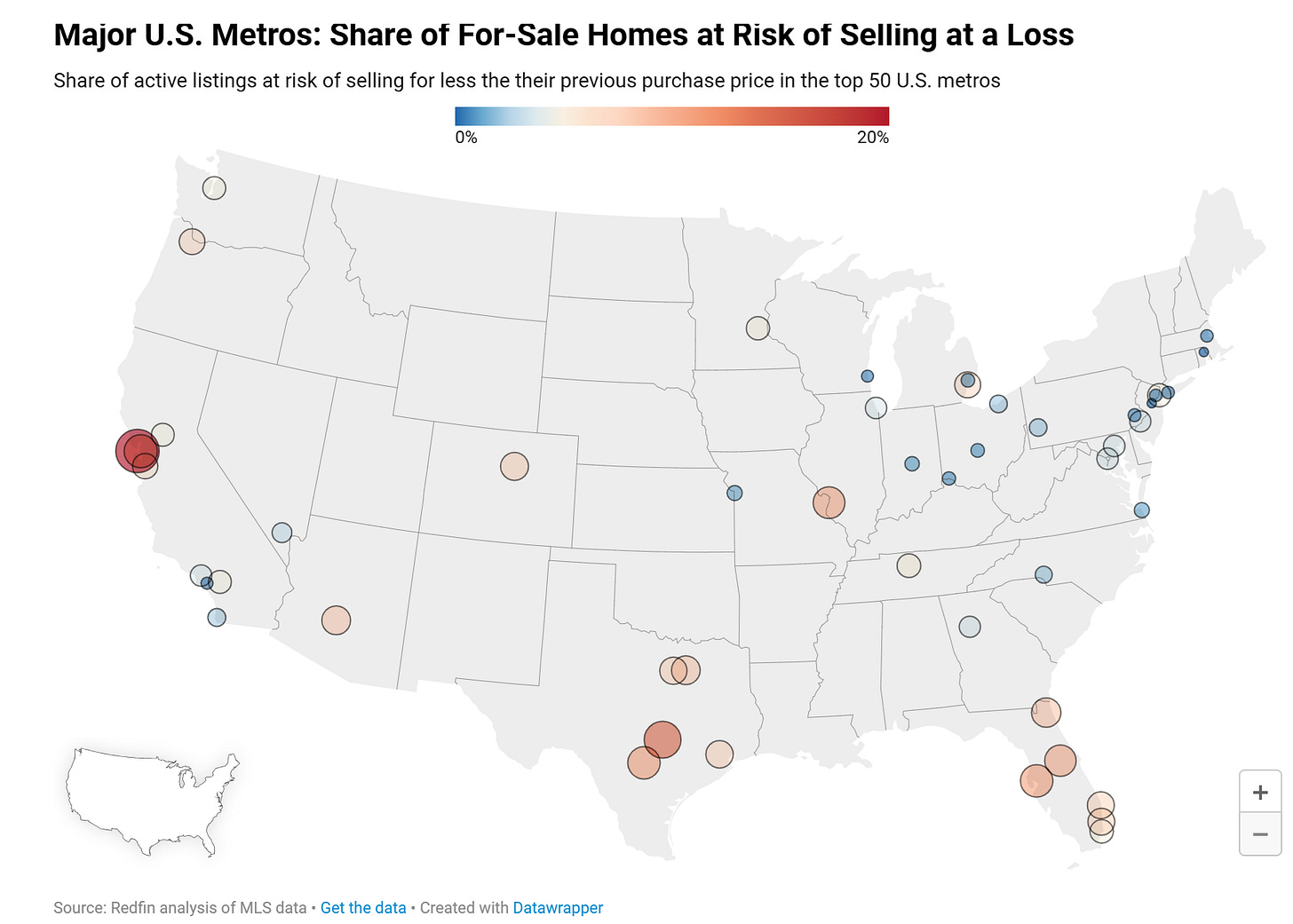

We’re not going to get a cascading series of bank failures from house prices going down this time around. And in aggregate, homeowners have built up a record amount of home equity, so currently the risk of selling at a loss is low.

But if there were to be a house price decline, we’d see this number start to climb, especially amongst those who bought post-pandemic.

As I’ve pointed out in previous posts, there is a strong regional dynamic to all of this.

It will be interesting to watch regional economic data in light of this regional housing slowdown. This economic expansion has been fueled by record amounts of housing and stock market wealth, so anything that hits that will also have an outsized economic impact.

The wealth effect is not even the most direct impact of a housing slowdown. As noted previously, existing home sales have been falling nationally, and the only thing keeping new home sales strong has been builder incentives. If the builders step back on building — as they might due to falling home prices in the areas where they are most able to build — this will have a direct effect on residential construction employment. And as you can see in the chart below, residential construction employment tends to be a recessionary bellwether.

I ecourage you to check out the Redfin post from which many of these charts came.