Ed Zitron's "The Case Against Generative AI"

A Bearish Take

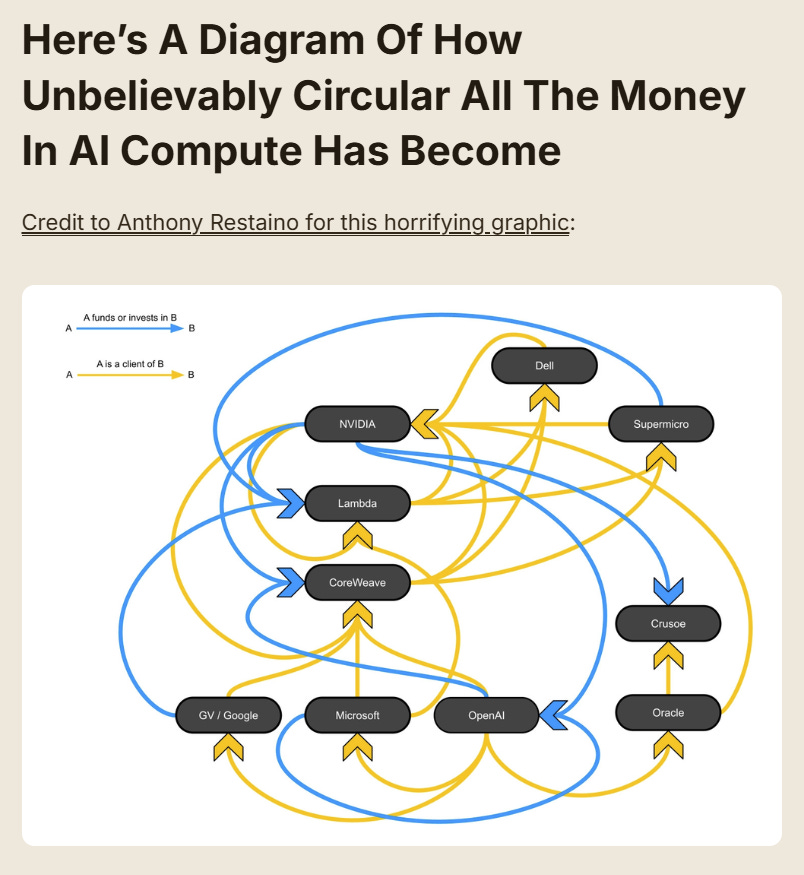

A reader sent me this long (and I mean long) article about the bearish take on AI as an elaboration of my point on the circular nature of AI spending.

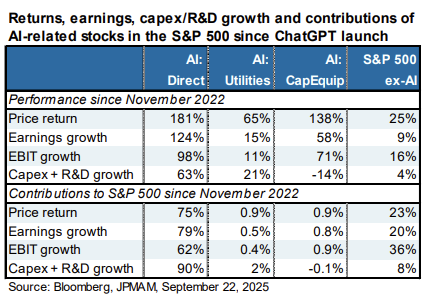

A Little More On The Stock Market Story

On Friday, I told the first of a few stories about the US economy that you could be telling.

I actually read the article, but the prospect of summarizing something so long was daunting, so I asked AI to do it for me. Unfortunately, but maybe appropriately given the subject matter, I thought the AI did a bad job so now I’m stuck doing it myself. This isn’t meant to be a full summary, just a highlighting of some points I thought were interesting.

This is sort of the main thesis:

You’ve likely seen a few ridiculous headlines recently. One of the most recent, and most absurd, is that that OpenAI will pay Oracle $300 billion over four years, closely followed with the claim that NVIDIA will “invest” “$100 billion” in OpenAI to build 10GW of AI data centers, though the deal is structured in a way that means that OpenAI is paid “progressively as each gigawatt is deployed,” and OpenAI will be leasing the chips (rather than buying them outright). I must be clear that these deals are intentionally made to continue the myth of generative AI, to pump NVIDIA, and to make sure OpenAI insiders can sell $10.3 billion of shares.

OpenAI cannot afford the $300 billion, NVIDIA hasn’t sent OpenAI a cent and won’t do so if it can’t build the data centers, which OpenAI most assuredly can’t afford to do.

NVIDIA needs this myth to continue, because in truth, all of these data centers are being built for demand that doesn’t exist, or that — if it exists — doesn’t necessarily translate into business customers paying huge amounts for access to OpenAI’s generative AI services.

NVIDIA, OpenAI, CoreWeave and other AI-related companies hope that by announcing theoretical billions of dollars (or hundreds of billions of dollars) of these strange, vague and impossible-seeming deals, they can keep pretending that demand is there, because why else would they build all of these data centers, right?

That, and the entire stock market rests on NVIDIA’s back. It accounts for 7% to 8% of the value of the S&P 500, and Jensen Huang needs to keep selling GPUs.

And, according to Ed, the reason these companies need to resort to this sort of circular model is because they aren’t really making any money.

Over half a trillion dollars has gone into an entire industry without a single profitable company developing models or products built on top of models. By my estimates, there is around $44 billion of revenue in generative AI this year (when you add in Anthropic and OpenAI’s revenues to the pot, along with the other stragglers) and most of that number has been gathered through reporting from outlets like The Information, because none of these companies share their revenues, all of them lose shit tons of money, and their actual revenues are really, really small.

Only one member of the Magnificent Seven (outside of NVIDIA) has ever disclosed its AI revenue — Microsoft, which stopped reporting in January 2025, when it reported “$13 billion in annualized revenue,” so around $1.083 billion a month.

Microsoft is a sales MACHINE. It is built specifically to create or exploit software markets, suffocating competitors by using its scale to drive down prices, and to leverage the ecosystem that it’s created over the past few decades. $1 billion a month in revenue is chump change for an organization that makes over $27 billion a quarter in PROFITS.

And a lot of that revenue is also circular (this, to some extent, is always the case, as in business-to-business spending one company’s cost is another’s revenue, but at the end of the day there needs to be some end-consumer paying for something to start the flywheel).

In a very real sense, the AI industry’s revenue is OpenAI and Anthropic. In the year where Microsoft recorded $13bn in AI revenues, $10 billion came from OpenAI’s spending on Microsoft Azure. Anthropic burned $5.3 billion last year — with the vast majority of that going towards compute. Outside of these two companies, there’s barely enough revenue to justify a single data center.

So that’s the crux of his argument. There is a vast amount of supporting evidence, but it would be a lot to summarize, so I’m just going to make a list of all the section headers to create an outline of what he’s saying.

The Markets Have Become Dependent On NVIDIA, and NVIDIA Is Taking Extraordinary, Dangerous Measures To Sustain Growth, Investing In Companies Specifically To Raise Debt To Buy Their Own GPUs

There Is Less Than A Billion Dollars In AI Compute Revenue Outside of NVIDIA, Hyperscalers and OpenAI, And NVIDIA Is Using Its Compute Deals To Help Neoclouds Raise More Debt To Buy More GPUs

Every AI Company Is Unprofitable, Struggling To Grow, And Generative AI’s Revenues Are Pathetic (around $61 billion in 2025 across all companies) comparable to their costs (hundreds of billions)

AI Companies Like Anthropic Can’t Control Their Users’ Costs

AI Software Businesses Like Replit Are Desperate, Abusing Their Customers To Try And Juice Their Revenues

Claude Code May Seem Popular, But It Only Makes $33 Million A Month — And That Was Before Rate Limits Kicked In

There Is One Popular Coding LLM — Github Copilot, With 1.8 Million Paying Subscribers — That Loses More Than $20 A Month Per User

Silicon Valley’s “Replacing Engineers With LLMs” Story Is A Lie

To Summarize: Coding LLMs Don’t Actually Replace Software Engineers, and Never Will, Due To The Inherent Unreliability Of Large Language Models

Even Microsoft Is Failing At AI, With Only 8 Million Active Paying Microsoft 365 Copilot Subscribers Out Of 440 Million+ Users

Microsoft Is Making Around $3 Billion On AI This Year (Outside of OpenAI) [This is revenue; in any case, Microsoft’s net income (read: profit) in its last quarterly earnings was $27.2 billion.]

This Bubble Is Unlike Anything You’ve Ever Seen [AI data centers are nothing like fiber, because there are very few actual use cases for these GPUs outside of AI, and none of them are remotely hyperscale revenue drivers]

OpenAI Needs More Than A Trillion Dollars ($500bn in operational expenses and at Least Another $625bn-$800bn+ for data centers), And There Is Not Enough Private and Venture Capital To Pay For It

OpenAI Claims It Will Make $200 Billion In Annual Revenue In Four Years’ Time — Its Projections Are Ridiculous, And I Don’t See How Its CFO Approved Them

The NVIDIA-OpenAI Announcement Is Bullshit, And No, NVIDIA Did Not “Give OpenAI $100 Billion” — In Fact, $90 Billion Of The Funding Is Contingent On OpenAI Building $125 Billion Of Data Centers with $200 Billion GPUs

OpenAI Needs More Than A Trillion Dollars In The Next Four Years — $325 Billion To Build The Data Centers Necessary To Receive $100 Billion In Funding From NVIDIA, $300 Billion It Owes Oracle, $100 Billion In Backup Compute Servers, Microsoft’s Compute, Broadcom, And Others

We’re In A Bubble, Whether You Like It Or Not

The World’s Private Credit and Venture Capital Cannot Afford OpenAI

That’s a lot of bullet points. I’ll leave you with Ed’s take on whether there will be something useful to come out of this after the bubble bursts:

GPUs are not trains, nor are they cars, or even CPUs. They are not adaptable to many other kinds of work, nor are they “the infrastructure of the future of tech,” because they’re already quite old and with everybody focused on buying them, you’d absolutely see one other use case by now that actually mattered. GPUs are expensive, power-hungry, environmentally destructive and require their own kinds of cooling and server infrastructure, making every GPU data center and environmental and fiscal bubble unto themselves.

I am telling you, as I have been telling you for years, again and again and again, that the demand is not there for generative AI, and the demand is never, ever arriving. The only reason anyone humours any of this crap is the endless hoarding of GPUs to build capacity for a revolution that will never arrive.

I thought Ed’s article was great, so set aside an hour or so and read the whole thing.

Disclaimer: The information provided on this blog is for informational purposes only and should not be considered investment, financial, or other professional advice. Nothing on this site constitutes a recommendation or solicitation to buy or sell any securities. You should consult with a qualified financial advisor before making any investment decisions. Investing involves risks, including loss of principal.

I've gone from Gary Marcus to Ed Zitron in reading about AI. Same take, Gary's a bit gentler, shall we say. They're convincing. Which poses the question, 'How could people be this insane?'. Well, Trump got reelected, so anything's possible..