Everything Isn't Enron

Just Because There Is An SPV Doesn't Make It Wrong

Paul Kedrosky looks at the recent news that Private Credit and Big Tech are working together to fund data centers and sees another Enron brewing:

Meta, which can raise money from banks at low rates any time they want to, increasingly choose ... not to. Instead, they turn to private investment groups—private equity, essentially—who can create custom financing for the project. And for which the company pays a significant premium over investment grade interest rates. How much more? As much as 200-300 basis points, or 2-3%. This is a juicy return on investment-grade company debt.

So, why would an investment-grade company agree to do that? They do it because the capital needed for these buildouts is so large that doing it with orthodox balance sheet debt, or by issuing sufficient equity, let alone spending your cash, would make a mess of your balance sheet.

By structuring it this way, via special purpose vehicles (SPVs) in which they have joint ownership, companies like Meta don't have to show the debt as their debt. It is the debt of those guys over there, that SPV. Not us. Granted, they retain shared control, and they get to use the AI data center, and nothing there happens without their say-so, but still. It's not ours.

This is accounting trickery, of course. It is a transparent attempt to raise large amounts of money without balance sheet damage by putting the debt in a vehicle you indirectly control, but that, for accounting reasons, doesn't have to be disclosed as your debt on your balance sheet. The accounting term of art is "control without consolidation".

This is a compelling argument for those who remember the Enron SPV house-of-cards that came tumbling down at the turn of the 2000s, but becomes less compelling when you consider that the thing Meta is trying to get out of this is data centers, not accounting revenue. Funding infrastructure—usually thought of as bridges and roads and the like—via project finance is not some grand scam, but rather pretty standard practice.

Private Credit is an ideal partner for this type of financing, as it is just Asset Based Lending on a large scale. And while Kedrosky makes a big deal about many Private Credit firms having insurance company relationships, insurance companies are one of the few sources of relatively permanent capital whose duration matches the long-dated nature of these infrastructure investments.

Now, the thing he says here about AI infrastructure spending representing a bubble could be true, but that’s not due to how it’s financed.

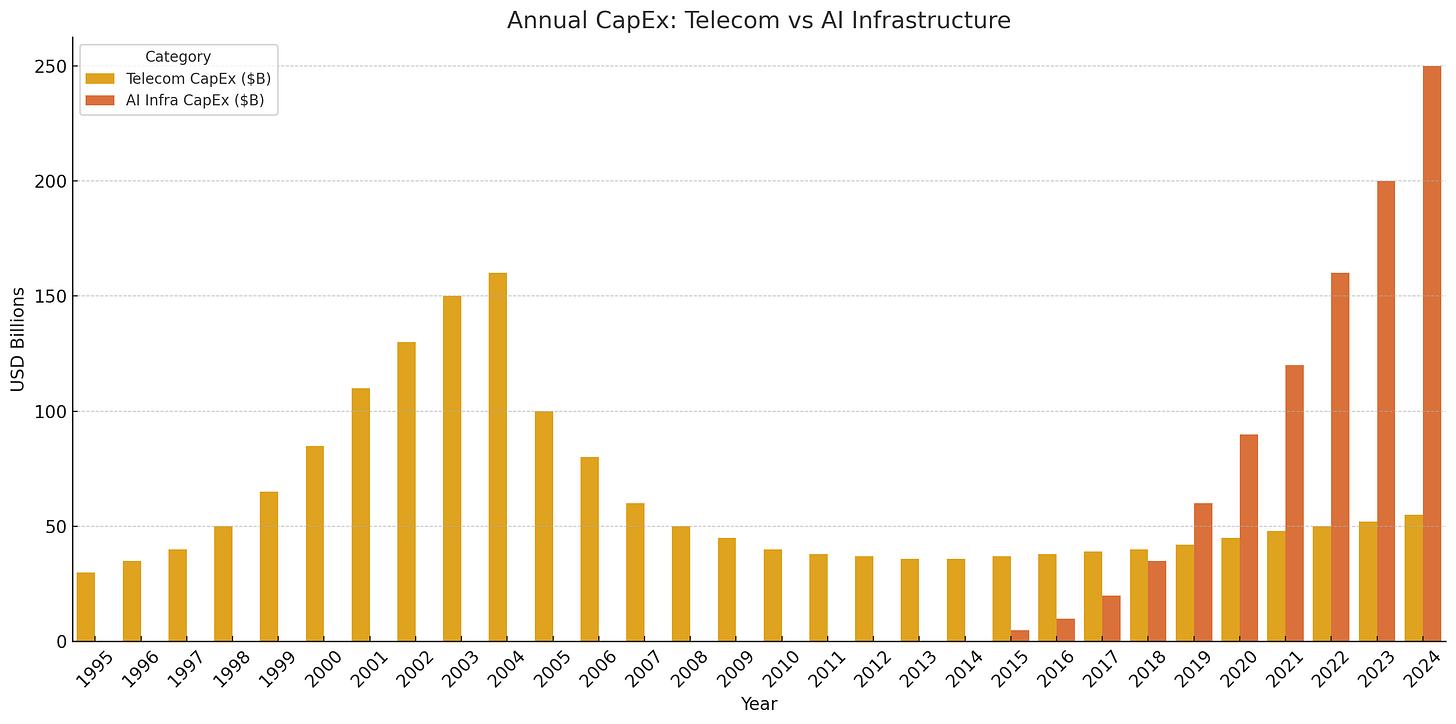

Here is a rough estimate of AI data center now vs telecom spending then during the dot-com bubble. We are already spending more now than then, driven by the same sort of hyperpolic projections of future usage and spending. They may turn out to be correct, but if the returns aren't there quickly, the thin equity cushion above datacenter SPV debtholders will be speedily wiped out.

Meta has probably learned the lessons of the telecom period, that the gains to capital investment didn’t accrue to those doing the investing. From their perspective, pooling the risk is a wise thing to do, and this structure looks to be the best way to do it.

Disclaimer: The information provided on this blog is for informational purposes only and should not be considered investment, financial, or other professional advice. Nothing on this site constitutes a recommendation or solicitation to buy or sell any securities. You should consult with a qualified financial advisor before making any investment decisions. Investing involves risks, including loss of principal.