Image Is Everything?

What Is The Point Of Information Warfare About Economic Data?

I promise I’ll get back to writing about real economic topics at some point, but at the moment I’m really quite interested in what is happening with the swarm of Chinese accounts putting out economic disinformation.

We already covered Kommunist Kevin and rare earths earlier this week

Am I A Target Of Information Warfare?

Twitter user Kommunist Kevin had some harsh words for me regarding my post on the US developing rare earths capacity.

But, like the Baader-Meinhof faction, once you see it in one place, you start seeing it everywhere.

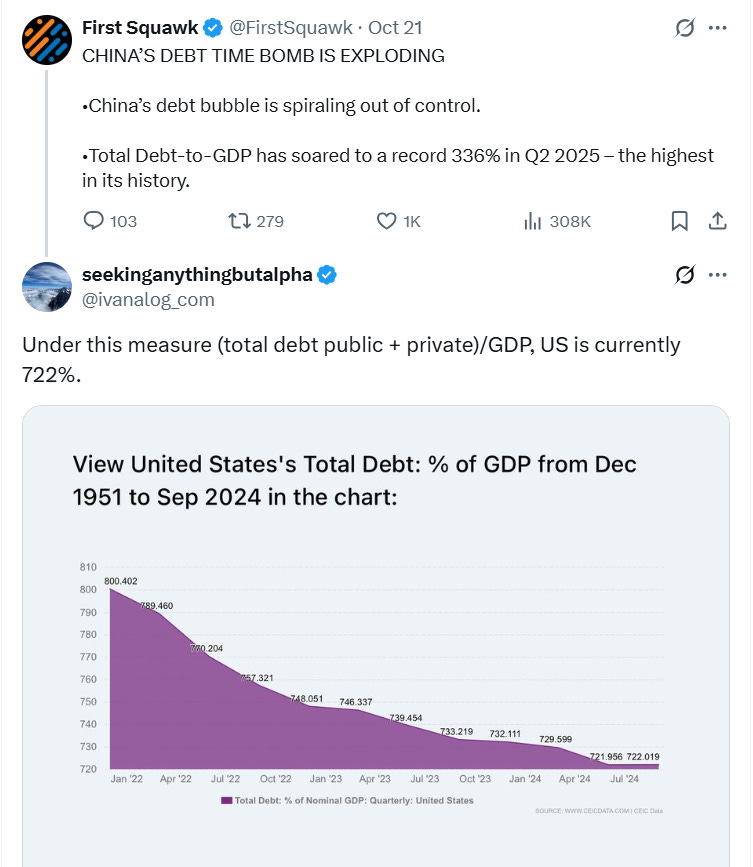

The most recent place I saw it was in this Twitter exchange.

Wow Ivanalog, how dare this anti-China Amerikan FASCIST besmirch China’s good name when the Evil Empire is the worst offender of all!!!!1!

Except that chart is all nonsense.

US total debt as a percent of GDP is not even close to 700%.

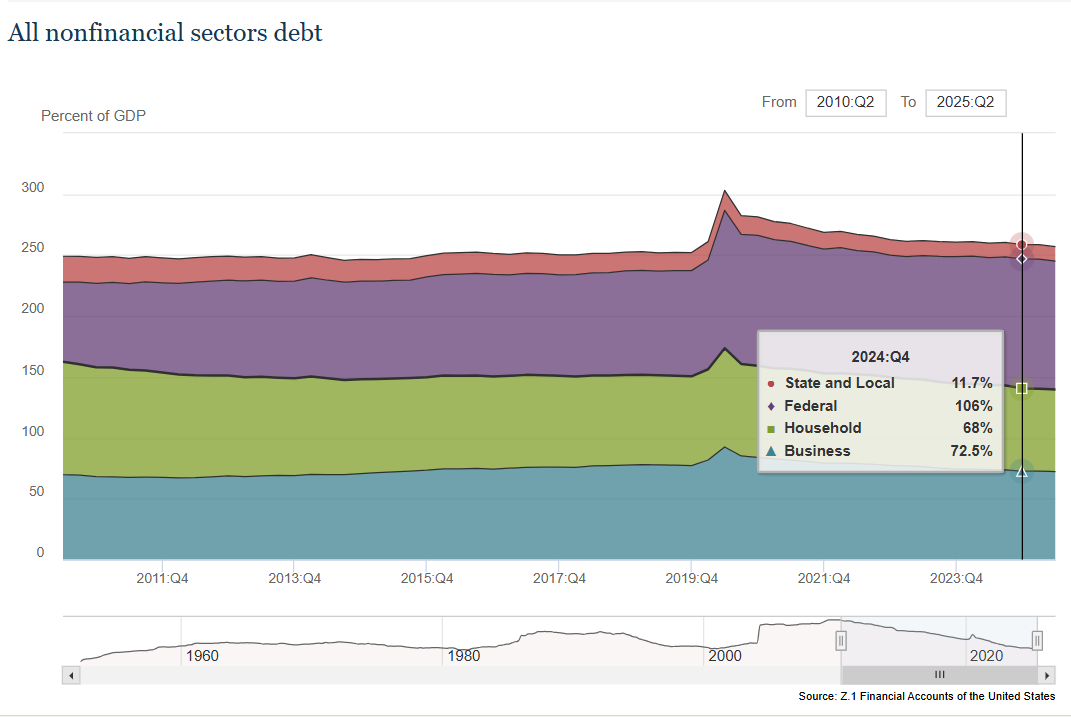

The Federal Reserve tracks all this, and the number is around 250%, not 700%.

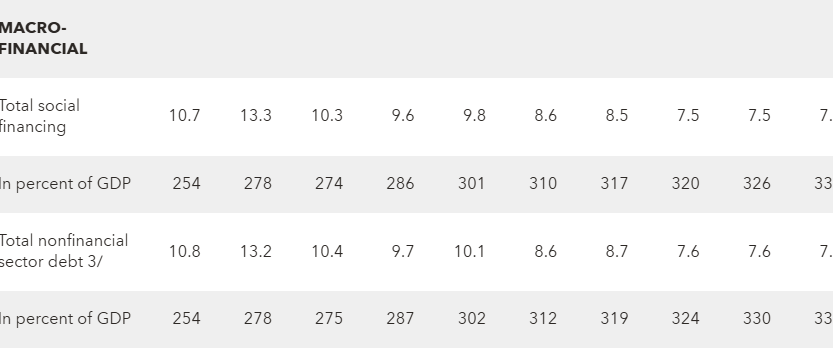

Meanwhile, the China figure is pretty accurate. According to the IMF, the amount of Total Social Financing (the best, equivalent measure to All Nonfinancial Sectors Debt in the US) was 310% of GDP at the end of 2024.

So, while I hate to be this guy, I think this is debunked.

I don’t think he was operating in good faith to begin with, though.

This has been a lot of words to spill on a Tweet that doesn’t even have 10,000 views. But it’s not really the content of the Tweet that interests me, it’s the fact that it exists at all. What is the point of posting this pretty obviously false (and easily verifiably so) information? What could this possibly accomplish?

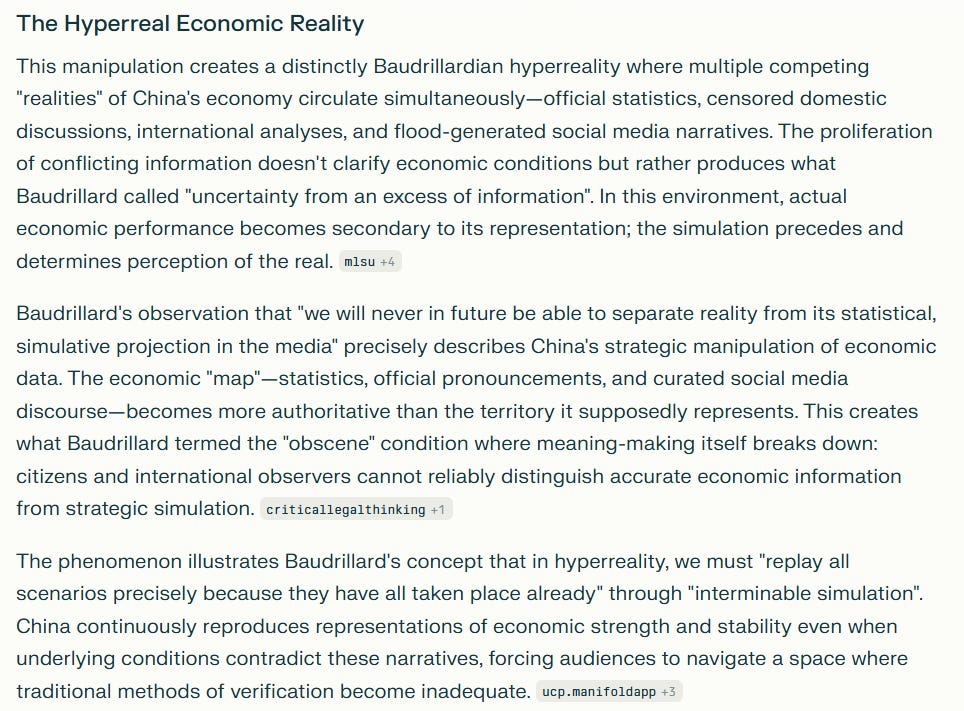

I try to keep these newsletters short, so I won’t go full Baudrillard-posting here, but this is exactly what he was talking about with his concept of the hyperreal. Here’s AI with the 80% version of the explanation:

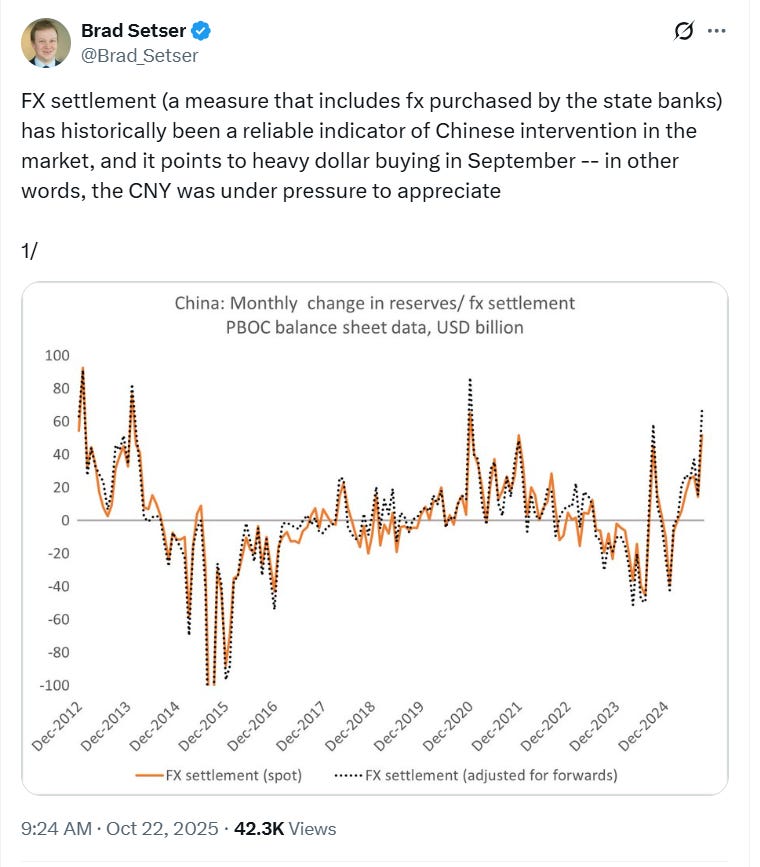

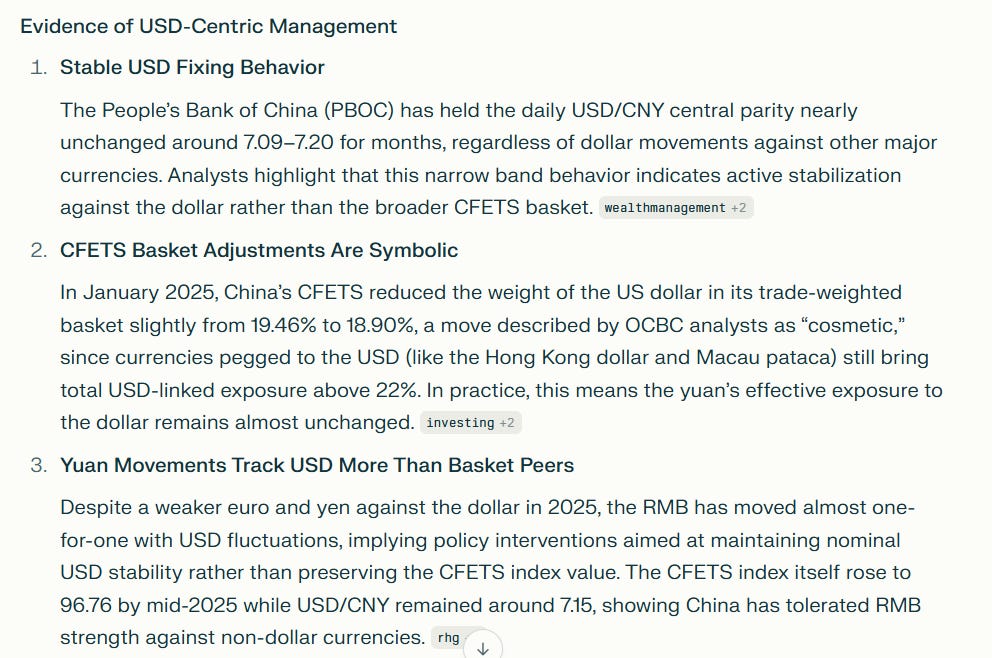

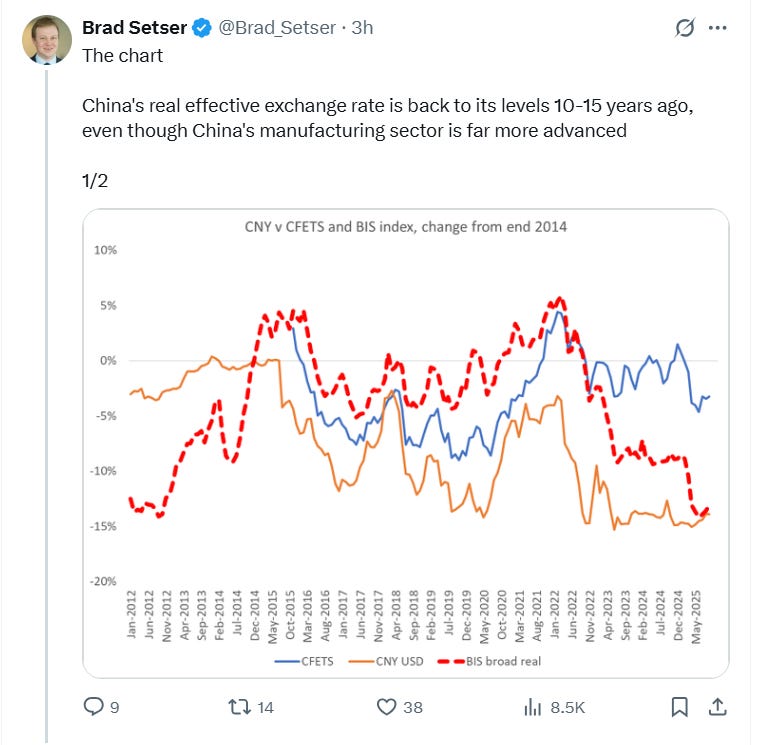

And it’s not really just Tweets where this applies. Take this Brad Setser post about Chinese exchange rate management.

In theory, China manages their currency against a basket of foreign currencies. This means that they take more than just the exchange rate against the dollar into account. In practice, though, it’s just the dollar.

There are economic reasons to do this, none of which are compatible with an actual free trade global system, that boil down to providing the most direct currency subsidy to the Chinese export engine, as it’s against the ultimate source of their demand.

But there is also an aspect of image management in this. Holding the yuan pretty constant versus the USD reinforces the image that China tries to project as the only stable actor in a world thrust into chaos by American perfidy. Resisting currency appreciation serves a real economic purpose for their export-reliant economy, but also serves a propaganda purpose in the hyperreal world of public opinion. And the swarm of Chinese economic misinformation I’m now noticing makes me wonder if, to them, the hyperreal is more important than the real.

Disclaimer: The information provided on this blog is for informational purposes only and should not be considered investment, financial, or other professional advice. Nothing on this site constitutes a recommendation or solicitation to buy or sell any securities. You should consult with a qualified financial advisor before making any investment decisions. Investing involves risks, including loss of principal.