Over the past couple of days, I’ve been saying that the Fed is walking into a policy bind, as inflation remains stubbornly high while the labor market looks to be cooling rapidly. What if, though, none of that is true?

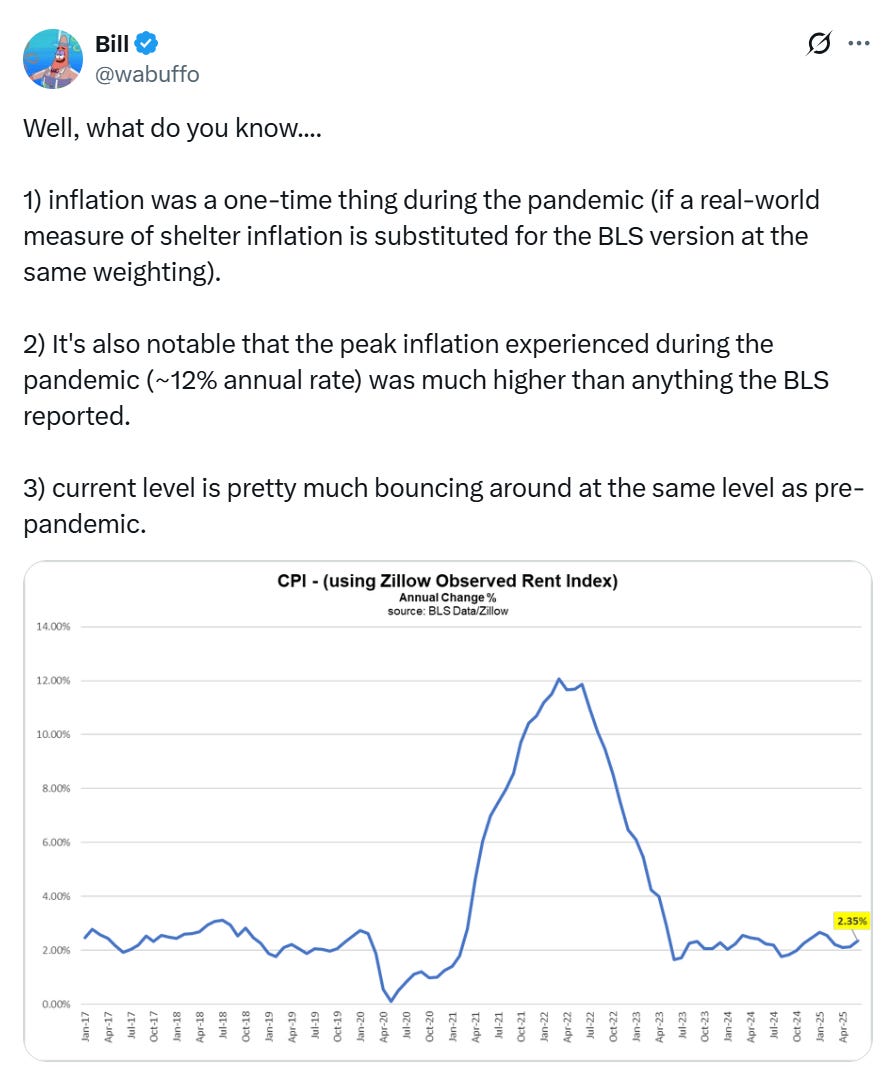

A more coincident version of CPI (using actual rent prices rather than the lagged version that actually goes into it) looks fine.

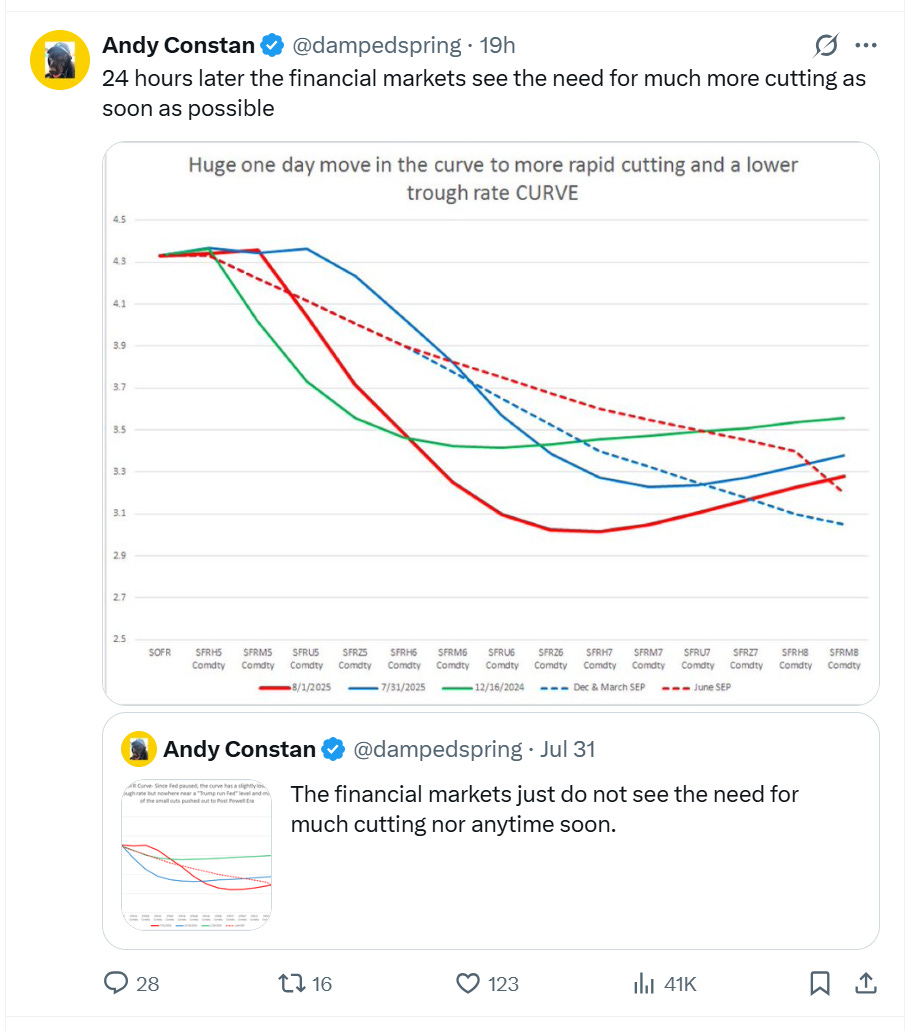

And on the labor market side, the unemployment rate is actually below where the Fed was projecting it to be at this time. When looked at from this perspective, the shift in market pricing after the jobs report on Friday looks overdone.

This all being said, I don’t think the shift in pricing actually was overdone. There’s an asymmetry in monetary policy that means that it’s easier to slow the economy with rate hikes than it is to stimulate with rate cuts. And a labor market cooling at this speed tends to be a self-reinforcing process, meaning that were the Fed to need to stop the slowdown, they would need to be easing aggressively already. I’m sympathetic to the Waller view that they should be easing already, but the right thing and the most likely thing are not necessarily the same.

Disclaimer: The information provided on this blog is for informational purposes only and should not be considered investment, financial, or other professional advice. Nothing on this site constitutes a recommendation or solicitation to buy or sell any securities. You should consult with a qualified financial advisor before making any investment decisions. Investing involves risks, including loss of principal.