More Involution Coming

Chinese Overcapacity Is Like A Balloon. If You Squeeze One Side Flat, The Other Bulges.

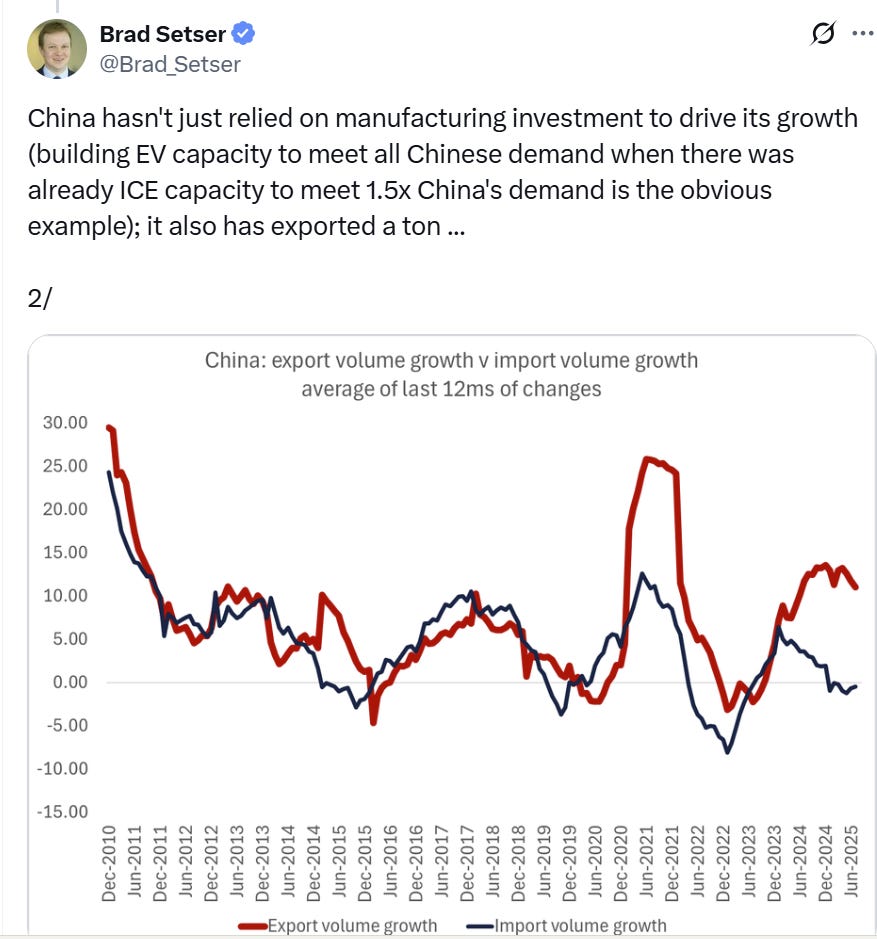

Brad Setser had a good chart illustrating that Chinese manufacturing overcapacity is really a result of having to pour investment into somewhere else after real estate became an unviable option.

And he goes on to make the point (I think it’s an obvious point, but probably an overstatement to say so) that because this capacity is so much larger than China needs to meet its own domestic consumption needs, it leads to massive amounts of exports.

He then posits that this means China is approaching the limits of its growth model, as the only remaining outlets for this excess capacity are raising domestic consumption (which would be a change in the growth model) or further raising exports (which is and will face massive pushback in the form of trade conflict with the rest of the world).

But Michael Pettis points out one more possibility, that to me seems the most likely.

Most of the pushback China is receiving on its export overcapacity is coming in targeted areas — autos, solar panels, etc. So if export restrictions are placed on these sectors, I’d expect manufacturing investment and thus new export overcapacity to just pop up somewhere new, as exporting domestic overproduction is the key feature of the Chinese growth model. China will keep cannibalizing global demand until they are stopped; waiting for them to decide to change on their own is a mug’s game, because from China’s perspective, the model still works. I know Michael Pettis would say generalized bilateral tariffs are not the most effective way of doing this, but the second-best solution you can implement is better than the perfect solution you can’t.

Disclaimer: The information provided on this blog is for informational purposes only and should not be considered investment, financial, or other professional advice. Nothing on this site constitutes a recommendation or solicitation to buy or sell any securities. You should consult with a qualified financial advisor before making any investment decisions. Investing involves risks, including loss of principal.