Quick Thoughts On Inflation

Another Data Release With Something For Everyone

The US CPI data released on Tuesday was another datapoint that had something in it to confirm whatever your preexisting view of the world may have been.

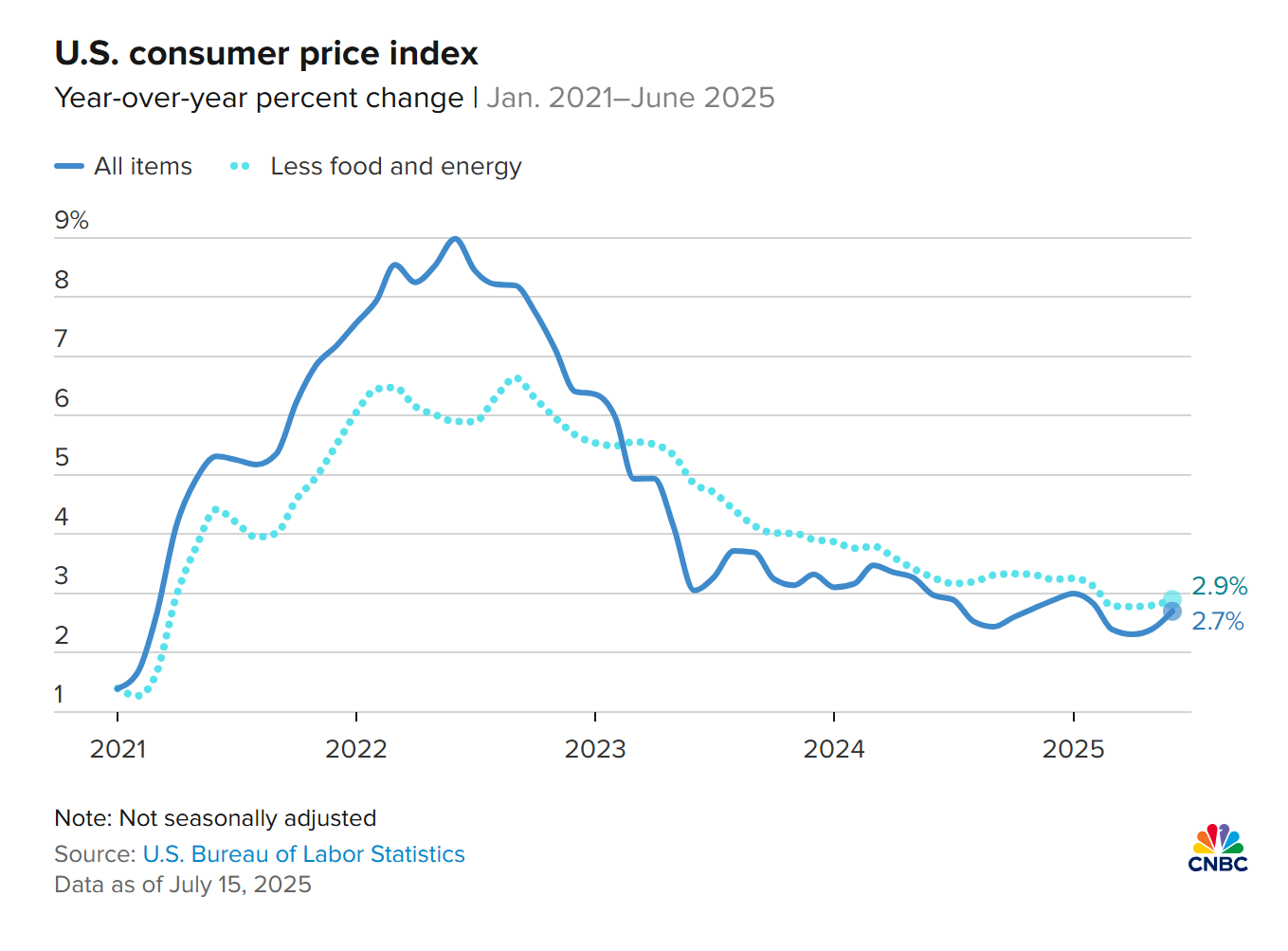

On one hand, monthly core inflation actually came in below expectations, and there certainly wasn’t a tariff-driven surge in inflation, with the level being basically stable around ‘higher than target but not out of control.’

On the other hand, there are plenty of signs under the hood that all is not well in inflation land.

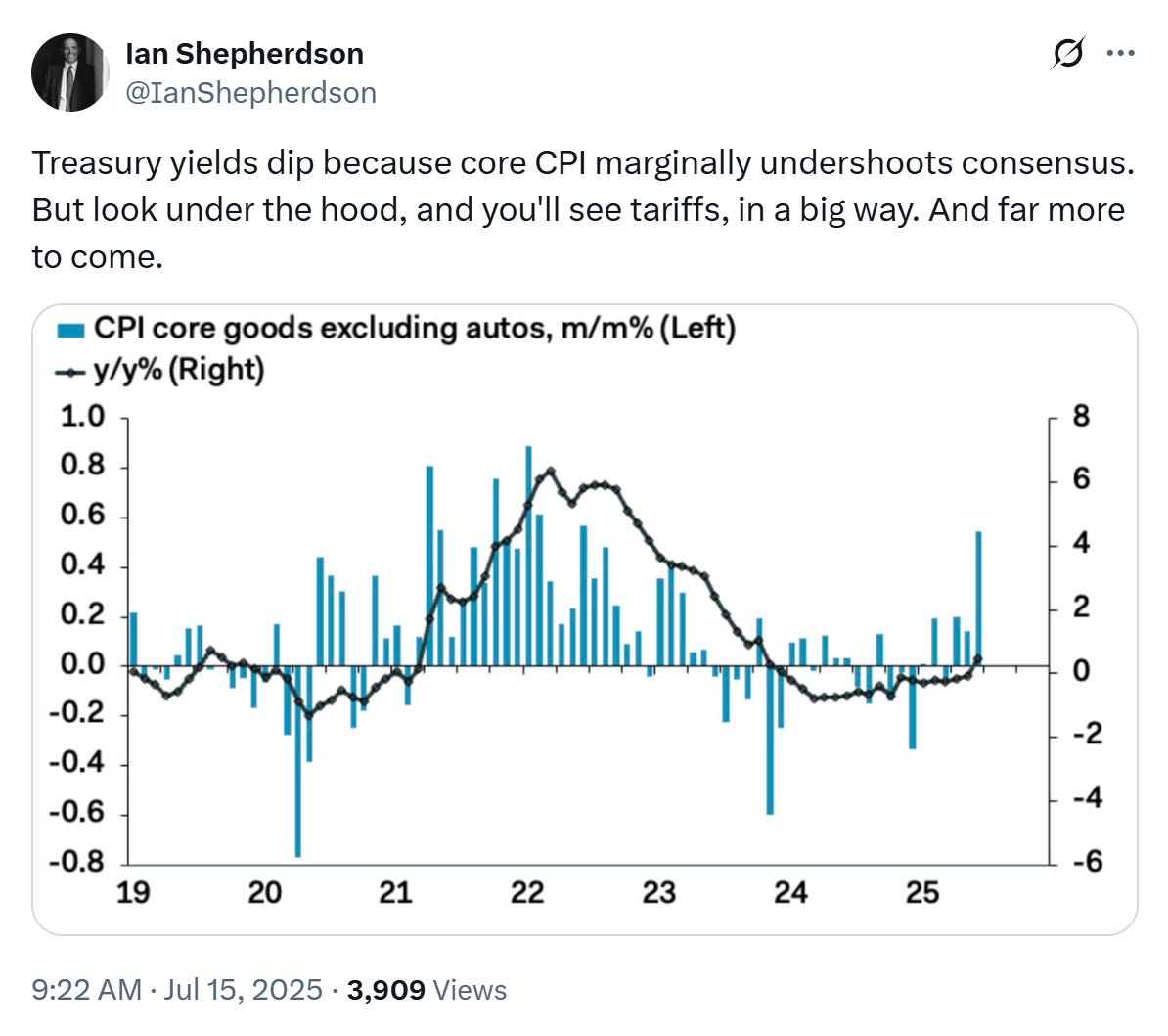

There are signs that tariffs may be starting to hit goods prices.

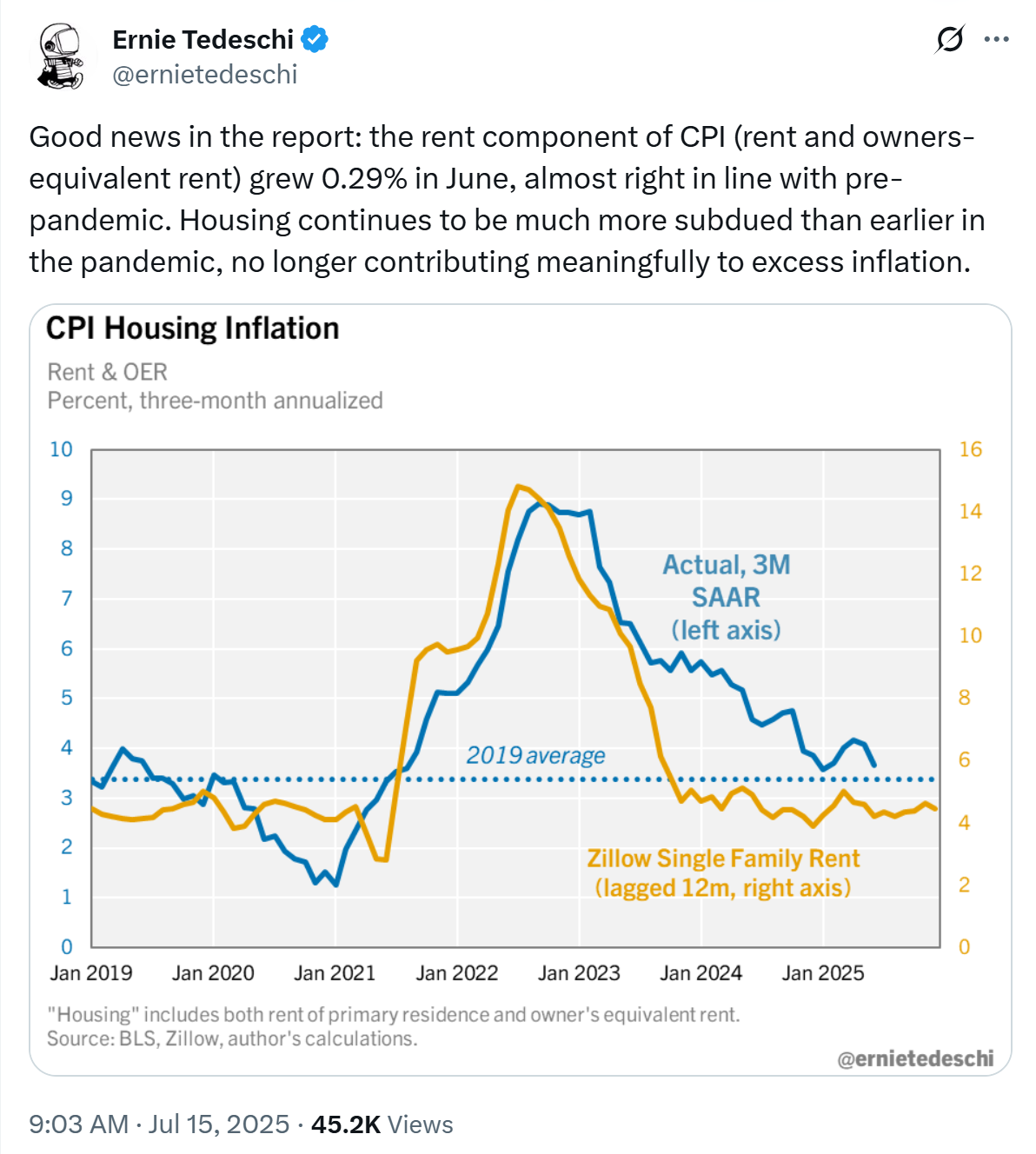

And a falling shelter component, which flows into the price index on a lag and has been a pretty consistent factor bringing the inflation index down, looks like it will probably be leveling off soon — i.e., no longer being a consistent contributor to falling inflation.

So, if you wanted, you could tell the story that, despite what you may read in the media, tariffs are not flowing through to higher consumer prices. You could also tell the story that they just aren’t flowing through yet, and that they will begin to do so imminently.

My view is that a tariff is a consumption tax that raises the cost of certain items without affecting aggregate demand, meaning either the quantity of those affected items demanded will fall (capping any potential for runaway inflation in those items), or the quantity demanded of other items will fall (as consumers have less money to spend on them as they’re already spending more on the affected items). Either way, the tariff effect on demand acts as a natural brake on runaway inflation.

I think this is not a smooth process, though, so the volatility of inflation will be higher than normal. Because of this, the Fed is probably right to continue to wait and see what happens.

In my recent piece on the labor market, I said only nerds look at anything but the topline. That may be true for the labor market, but with inflation I think it pays to look beneath the hood. The reason for this is simple: in level terms, the Fed is already at their unemployment target but isn’t there on inflation yet. They feel they’ve almost got inflation under control, but don’t want to blow it at the finish line. Chair Powell doesn’t want to be remembered as a nearly-man, so as long as he’s still calling the shots, the Fed will err on the side of inflation control rather than caring about a weakening labor market.