Maybe AI IS Taking All The Jobs

Even Though Proof Of This Is Hard To Come By, Signs Are There

Yesterday I shared a long screed on how, among other things, it’s laughable to think that AI is going to take all of our jobs because it kind of stinks at doing a lot of them.

Ed Zitron's "The Case Against Generative AI"

A reader sent me this long (and I mean long) article about the bearish take on AI as an elaboration of my point on the circular nature of AI spending.

This being said, it’s hard to look at the diverging trends in AI capex and the cooling labor market and not see some sort of connection.

Toby Nangle at FT Alphaville takes a look at this and agrees, yes, this is pretty unusual.

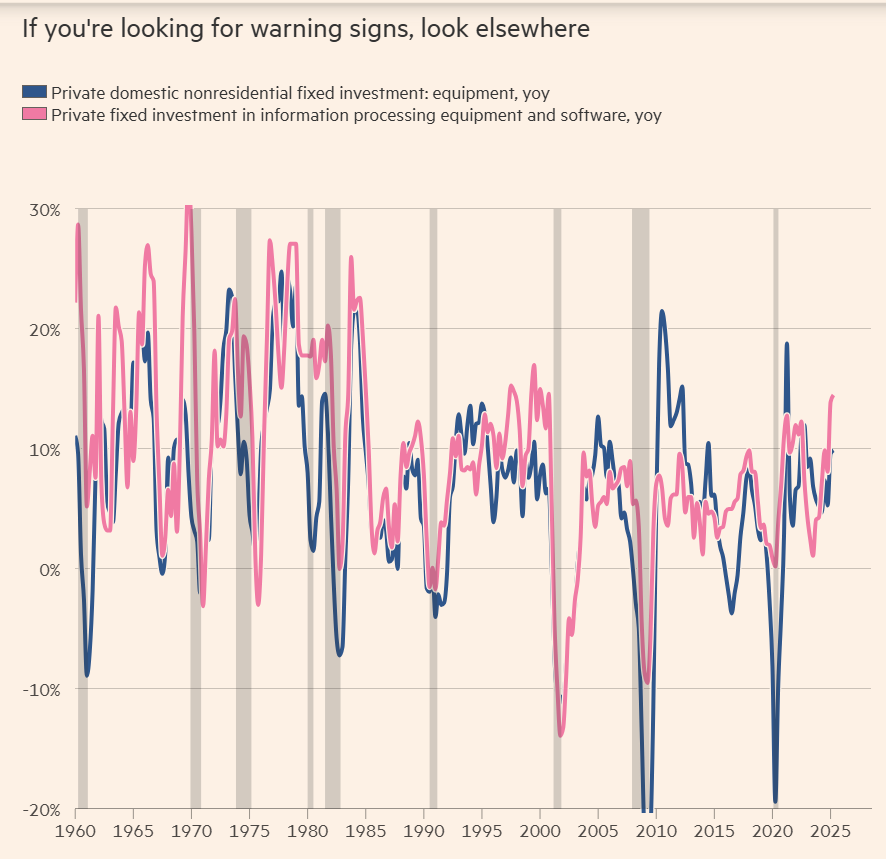

While not every contraction in equipment spend has been accompanied by a recession, every recession since 1981 has been accompanied by a fall in equipment spending.Looked at through this prism the best answer to whether we’re in for a hard or soft landing is maybe ‘are you kidding me’?

But you know what else has accompanied every recession since 1960? The kind of tepid growth of private jobs, the likes of which we’re seeing today:

When I look at the juxtaposition of those two charts, it certainly looks like AI is taking a bunch of jobs. But when you look at productivity numbers, AI doesn’t really show up at all. This raises a third possibility that is almost too funny (if it weren’t so scary) to contemplate — AI is taking a bunch of jobs but stinks at doing them.

The obvious rejoinder to this is that AI might stink at doing the jobs now, but the investment will pay off over time and the productivity boost is right around the corner. We shall see if this pans out, but the longer this trend goes on, the bigger the hit to the economy if it doesn’t work.

Disclaimer: The information provided on this blog is for informational purposes only and should not be considered investment, financial, or other professional advice. Nothing on this site constitutes a recommendation or solicitation to buy or sell any securities. You should consult with a qualified financial advisor before making any investment decisions. Investing involves risks, including loss of principal.