AI Money Keeps Sloshing Around

The OpenAI-AMD Deal Is The Most Recent Example

It feels like I just got done writing about how the circular AI economy is fueling bubble concerns. But here I am, writing about it again, because there is more news on this front.

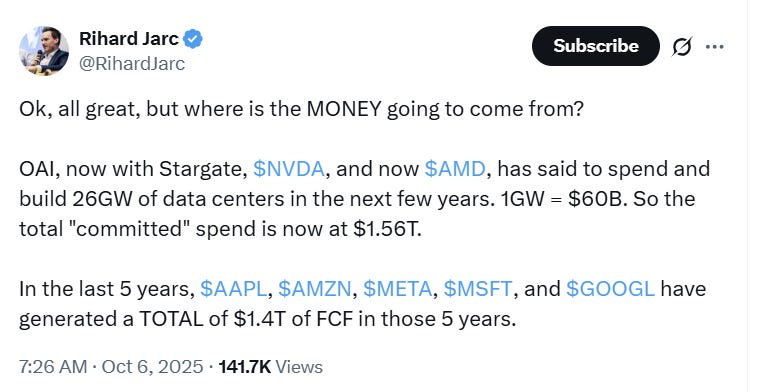

In many ways, this should look like positive news, as the spending within the ecosystem is moving outside of just Nvidia, but when I see something like this, I get a little curious:

OpenAI also will have the ability to buy as many as 160 million shares of AMD at a penny apiece, equivalent to about 10% of its outstanding stock, which will take effect when the project hits certain milestones. Those targets require AMD’s share price to continue to increase in value and future exercise points include a tranche tied to a share price of $600. AMD shares closed Friday at $164.67.

I’m semi-sleep deprived, so maybe I’m not thinking straight, but that looks like OpenAI can make a $96 billion profit on their AMD shares by continuing to promise to spend money with AMD.

As the old saying goes, it takes money to make money, and that seems to be the case here as well:

It’s unclear how exactly OpenAI will finance the enormous costs associated with the chips and data centers needed to build and run more advanced AI systems. Two months ago, OpenAI Chief Executive Officer Sam Altman said he wants to spend “trillions” on infrastructure to secure the computing resources he thinks the company needs for AI services. To bankroll that, Altman said his company is working to devise a “new kind” of financial instrument, without providing details.

What seems clear is that, unless OpenAI is more insanely profitable than all the other insanely profitable tech companies combined, the money is going to have to come from capital markets.

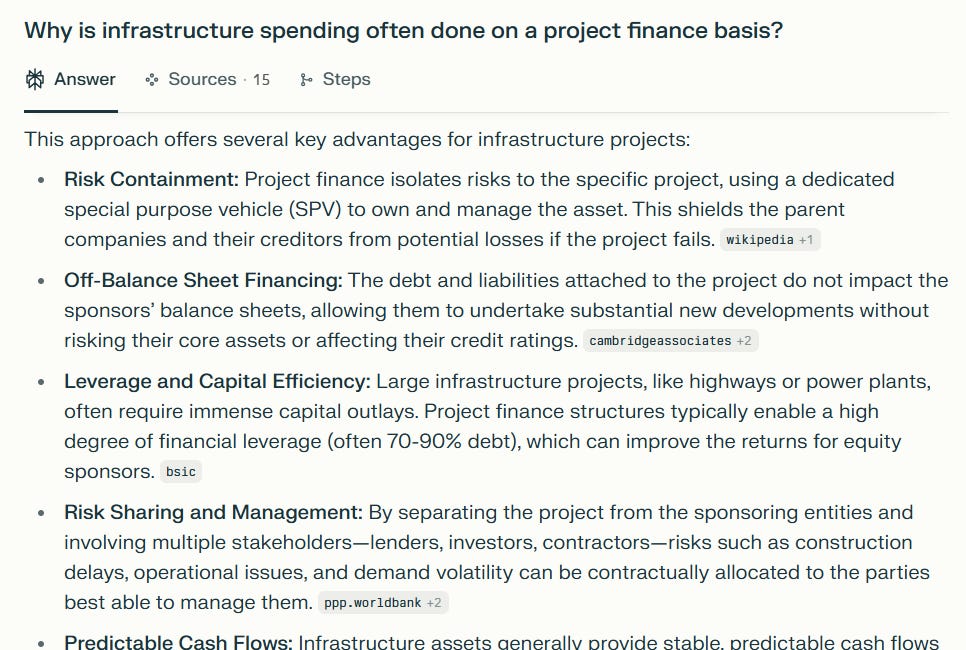

I’ve written before about how private markets are actually pretty well set up to raise money for these sorts of projects, but the thing about using project finance in this way is that the spending needs to see some kind of return.

Everything Isn't Enron

Paul Kedrosky looks at the recent news that Private Credit and Big Tech are working together to fund data centers and sees another Enron brewing:

As the amount of outside capital necessary to fund the AI spending binge begins to grow, so too does the urgency that this thing starts to make money (and a lot of it).

Disclaimer: The information provided on this blog is for informational purposes only and should not be considered investment, financial, or other professional advice. Nothing on this site constitutes a recommendation or solicitation to buy or sell any securities. You should consult with a qualified financial advisor before making any investment decisions. Investing involves risks, including loss of principal.